What the Bank of Canada’s Rate Cut May Mean for Vancouver Island Real Estate

- steve451522

- Sep 19

- 3 min read

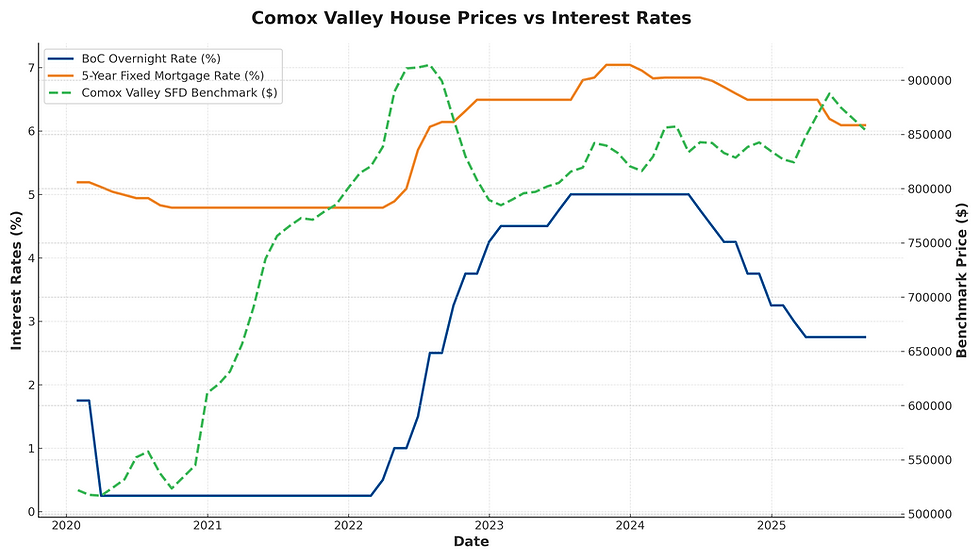

On September 17, 2025, the Bank of Canada reduced its overnight lending rate by 25 basis points to 2.50% the lowest level in three years. The decision reflects a slower national economy, easing inflation, and rising unemployment pressures.

While policy shifts in Ottawa can feel distant, their effects reach right into the Vancouver Island housing market. Lower rates change how buyers qualify for mortgages, how sellers price property, and how lenders assess risk. For homeowners, the implications are personal; for appraisers, they are practical and immediate.

At Jackson & Associates, we’re focused on what this means here in our local market V.I. market areas.

Mortgage Relief for Homeowners and Buyers

Lower rates translate directly into lower borrowing costs. For homeowners with variable-rate mortgages (or those facing renewal) this means smaller monthly payments. For buyers, it may improve affordability and qualification thresholds, making a wider range of properties possible. Remember that ±60% of Canadian mortgages are up for renewal in 2025-2026 and that household mortgage debt in Canada exceeds $2.25 TRILLION.

On Vancouver Island, where incomes and property prices often sit in tension, this shift creates breathing room. First-time buyers may find themselves able to enter the market. Move-up buyers may stretch further without overextending. But affordability is improved only at the margins structural housing costs remain high, and not every buyer will see a transformative change.

Renewed Demand Pressure

Every rate cut carries the potential to bring sidelined buyers back into the market. For Vancouver Island, that could mean heightened competition in segments that we see are softening a bit in our local markets: mid-priced family homes, suburban subdivisions, and select rural properties.

This resurgence in demand often happens unevenly. Desirable neighbourhoods and well-located properties may experience multiple offers more quickly, while less competitive listings continue to linger. The lesson: market activity increases, but not all sellers benefit equally.

What Sellers Should Expect

When demand firms, sellers usually see shorter marketing times and stronger offers. In markets with already constrained supply (like Victoria, Nanaimo, and the Comox Valley) prices could edge higher.

That said, sellers shouldn’t expect automatic appreciation. The balance between new listings and new buyers remains critical. In communities with more balanced inventories, price growth may be muted even as activity picks up.

Long-Term Affordability Challenges

A rate cut is certainly not not a cure-all. Vancouver Island still contends with long-standing supply challenges, elevated construction costs, and rising municipal development cost charges, and amenity cost charges. These realities mean affordability remains strained for many households, regardless of modestly cheaper mortgages.

There is also the broader economic backdrop: slower growth, job market uncertainty, and lender caution. These factors could limit how far renewed demand translates into sustained price gains.

What to Watch on Vancouver Island

The impact of the Bank’s decision will show up differently across our region. Key variables that we will monitor include:

Inventory levels – Whether new listings expand alongside renewed demand.

Migration patterns – If retirees, remote workers, or new residents accelerate moves to the Island.

Local approvals – The pace of new housing construction and municipal permitting.

Regional variation – Divergences between Nanaimo, Comox Valley, Campbell River, and smaller Island markets.

Jackson & Associates’ Perspective

Our role is to bring clarity to these shifting conditions. Lower interest rates affect not only buyers and sellers, but also lenders, municipalities, and investors. A thorough appraisal grounds decisions in evidence, helping clients see past headlines to the real forces shaping value.

Whether you are purchasing, refinancing, or thinking of listing, it is important to understand how national policy changes play out in our local markets. Vancouver Island is not a single story; it is a series of micro-markets, each responding differently to changing credit conditions. We know these micro-markets with a comprehensive database of transactions dating back to the middle of the last century.

Final Thought

The Bank of Canada’s rate cut provides relief and opportunity, but it also introduces new dynamics into an already complex market. Clarity comes from careful analysis, not assumptions.

At Jackson & Associates, we provide appraisals and market insights that help clients navigate these changes with confidence. If you have to make a real estate decision in this evolving environment, we are here to support you and your clients.

Comments